Banking is a business that is based on profits, and banks still earn pa lot of money, and fees are an important source of their profits. That means that people who do pay fees make up for everybody else – sometimes paying thousands of naira or more each year. If you are paying fees to your bank, find out what they are, what they are costing you, and how you can put an end to those costs, according to https://www.thebalance.com.

Maintenance fees: Some banks charge a fee just to have an account.

These monthly maintenance fees are an automatic feature. For most, that kind of fee will more than eat up any interest you earn throughout the year, and you might even have a hard time keeping your account balance above zero.

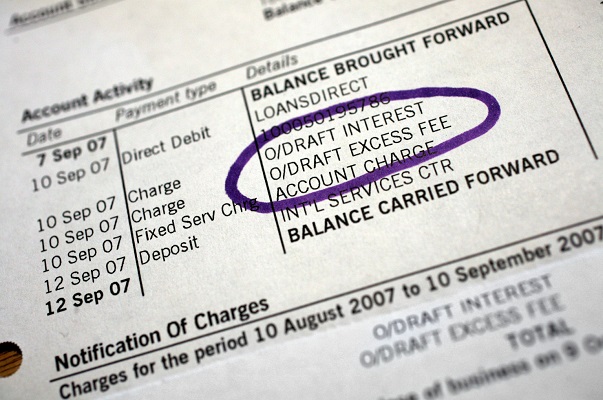

Maintenance fees are relatively easy to avoid. You can either: use a bank that does not charge maintenance fees, or qualify for a fee waiver so that the fees don’t get charged *Overdraft and insufficient funds: Overdraft charges and fees for insufficient funds can cost as much or more than maintenance charges over the course of a year. Whenever your account balance runs low, you are in danger of paying these fees.

Fortunately, overdraft fees are optional. Banks used to sign you up for overdraft protection automatically, but now you need to opt-in for the service. In most cases, you would rather just have your card declined. If you are interested in overdraft protection, it is worth researching the options. Some banks will transfer money from your savings account to your current account for an amount and others will offer overdraft lines of credit (which charge interest on the amount you “borrow” instead of a high flat-rate fee per transaction).

You might think you are in the clear if you never opted-in to overdraft protection. But you will still pay fees if your account balance runs to zero and charges hit your account. For example, you might have set up automatic mortgage or insurance payments from your current account (so your biller pulls the funds out each month). Those payments are handled differently – opting out of overdraft protection only prevents you from overspending with your debit card.

If transactions draw your account balance below zero, your bank will charge a fee for insufficient funds.

How can you avoid overdraft and NSF fees? The easy answer is to keep enough money in your account. But it is hard to pull that off when money is tight and electronic transactions pull money out without you knowing about it.

Keep track of how much you have in your account, and even how much you will have in your account next week. If you balance your account regularly, you will know which transactions have already gone through and which ones you are still waiting for. Your bank might show that you have a certain amount of money available – but you will know that not all of your bills have hit your account yet.

It’s also helpful to set up alerts. Have your bank text you when your account balance runs low. You will know that you need to change or cancel payments, or transfer funds over from a savings account.

As a safety net, you might also want to set up an overdraft line of credit. Hopefully, you won’t make a habit of using it, but it is a less expensive way to handle occasional mistakes.

ATM fees: ATM fees are among the most annoying bank fees. Most people don’t blink when they pay maintenance fee, but they hate the idea of paying to get their own money from an ATM. That makes sense: those fees can easily add up to five or ten per cent of your total withdrawal (or more).

If you use ATMs frequently, you need a way to avoid those fees. The best approach is to use ATMs that are owned or affiliated by your bank. You won’t pay your bank’s “foreign” ATM fee, nor will you pay an additional fee to the ATM operator. Use your bank’s mobile app to find free ATMs.

- Piggy fire: There are countless ways to pay fees to your bank. Keep an eye out for these fees:

Wire transfer: Wire transfers are great for sending money quickly, but they are not cheap. If you don’t really need to send a wire, find a less expensive way to send funds electronically.

Account closing fee: Banks ding you when you close an account shortly after opening it. If you have changed your mind about a bank, wait at least three to six months before closing your account to avoid fees.

Excess transfers: Some accounts limit the number of transactions (especially transfers out of the account) allowed per month. Money market accounts, which offer some of the benefits of both current and savings accounts, might limit your withdrawals per month. If you are going to spend money from those accounts, plan ahead and move the money to your current account in larger chunks.

Early withdrawal penalties: fixed deposits often pay higher interest rates than savings accounts. You need to commit to leaving your money in the account for a long time. If you pull out early, you will pay a penalty.